The year is shaping up well, although there is still some impact left from 9/11, according to Nigel Lingaard, director of marketing at Fred. Olsen Cruise Lines. “The bookings were good from January through March,” he said, “but April has been quiet for all of us. And May and June will probably be quiet too. There are too many events that distract the market, such as the Queen’s Jubilee, the World Cup, and holidays,” Lingaard said.

The year is shaping up well, although there is still some impact left from 9/11, according to Nigel Lingaard, director of marketing at Fred. Olsen Cruise Lines. “The bookings were good from January through March,” he said, “but April has been quiet for all of us. And May and June will probably be quiet too. There are too many events that distract the market, such as the Queen’s Jubilee, the World Cup, and holidays,” Lingaard said.

He also said that the discounts offered in the British market were greater than ever. The problem that many companies find themselves in is that they fill their ships with two sets of people: those who have paid the full rate and those who took advantage of the deep discounts.

For a relatively small cruise operation such as Fred. Olsen, there is not much room to maneuver in terms of cost cutting, according to Lingaard, who underscored that the cruise line will not compromise its product. At the same time, it has little opportunity to recover revenues through onboard spending. Lingaard said that Fred. Olsen’s passengers don’t gamble much nor do they drink much. Seven to eight percent of the company’s revenues come from onboard spending. “We are a low-key operator; there are few big spenders onboard,” Lingaard said.

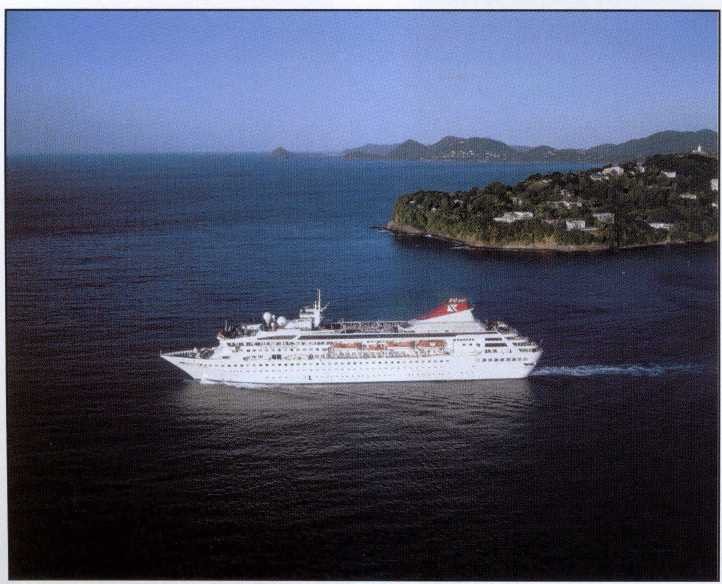

Introducing the Braemar (the former 1993-built Crown Dynasty) last year, Fred. Olsen has grown to three ships. “We are focusing on offering a consistent product on the three ships,” Lingaard explained. “The hardware may be different, but the software is the same,” he added.

“We are very pleased with the new ship,” Lingaard continued. “She settled in quickly and became a part of our fleet very smoothly. It was much easier for us to go from two to three ships than it was to go from one to two,” he added.

Lingaard said that Fred. Olsen rotates staff between the vessels so passengers can bump into favorite crewmembers no matter what ship they are on. The ships are four-stars-plus in terms of cuisine, service and ambiance, according to Lingaard.

During the summer all three ships will sail out of Great Britain.

The 02/03 winter program calls for the Braemar to sail in the Caribbean, the Black Watch to sail long cruises out of the U.K., while the Black Prince will sail out of the U. K. as well as out of Malaga, Spain.

Looking forward, Nigel said that Fred. Olsen will have to grow in order to maintain its market position. “You need a certain market share in order to have a voice in the market,” he said. “When the other companies grow, we must grow too to protect our market share and to make sure we are on the travel agents’ shelves as well. If we stay put, our share will drop. Eventually, we will need a fourth ship.”

Presently, Fred. Olsen commands four percent of the U.K. market in terms of passengers, according to Lingaard, and seven percent in terms of revenues. “Our cruises are longer,” he explained.

But Lingaard is not unhappy about the growth of the industry. He said the big companies help spread the word about cruising. Fred. Olsen does not target first- timers, but rather experienced cruise passengers.

“We depend on other companies growing the market,” Lingaard said. “But Fred. Olsen Cruise Lines’ brand awareness in the U.K. market exceeds that of all others except for P&O and Cunard,” he added. Ninety-six percent of Fred. Olsen’s passengers are British. Lingaard said it was useful, however, to have an international presence and “be able to pick up a few passengers elsewhere in difficult times.”

“We are determined to stay a four- star-plus product,” said Lingaard, who noted that with all the big new ships being built, all the companies should not migrate up the product ladder. Lingaard does not see the point of leaving a market niche to move on to a more competitive market and let somebody else take over where the company is successful.

“We enjoy a unique niche with our relatively small ships – 400 to 700 passengers — British ambiance and rather unusual itineraries,” Lingaard said. “We are what we like to call middle-England.” The passengers’ average age is 66 – mostly recently retired schoolteachers, bank managers and self-employed entrepreneurs.