Page 2 - CIN 2019 European Report

P. 2

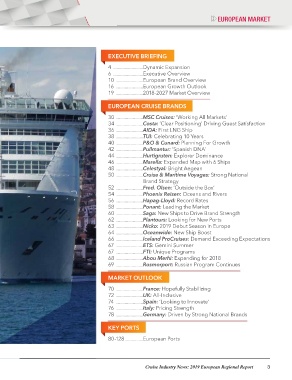

}EUROPEAN MARKET

EXECUTIVE BRIEFING

4 ................................Dynamic Expansion

6 ................................Executive Overview

10 .............................European Brand Overview

16 .............................European Growth Outlook

19 .............................2018-2027 Market Overview

EUROPEAN CRUISE BRANDS

30 .............................MSC Cruises: ‘Working All Markets’

34 .............................Costa: ‘Clear Positioning’ Driving Guest Satisfaction

36 .............................AIDA: First LNG Ship

38 .............................TUI: Celebrating 10 Years

40 .............................P&O & Cunard: Planning For Growth

42 .............................Pullmantur: ‘Spanish DNA’

44 .............................Hurtigruten: Explorer Dominance

46 .............................Marella: Expanded Map with 6 Ships

48 .............................Celestyal: Bright Aegean

50 .............................Cruise & Maritime Voyages: Strong National

..........................Brand Strategy

52 .............................Fred. Olsen: ‘Outside the Box’

54 .............................Phoenix Reisen: Oceans and Rivers

56 .............................Hapag-Lloyd: Record Rates

58 .............................Ponant: Leading the Market

60 .............................Saga: New Ships to Drive Brand Strength

62 .............................Plantours: Looking for New Ports

63 .............................Nicko: 2019 Debut Season in Europe

64 .............................Oceanwide: New Ship Boost

66 .............................Iceland ProCruises: Demand Exceeding Expectations

67 .............................ETS: Gemini Summer

67 .............................FTI: Unique Programs

68 .............................Abou Merhi: Expanding for 2018

69 .............................Rosmorport: Russian Program Continues

MARKET OUTLOOK

70 .............................France: Hopefully Stabilizing

72 .............................UK: All-Inclusive

74 .............................Spain: ‘Looking to Innovate’

76 .............................Italy: Pricing Strength

78 .............................Germany: Driven by Strong National Brands

KEY PORTS

80-128 ..................European Ports

Cruise Industry News: 2019 European Regional Report 3