“Cruises continues to deliver a strong performance, taking into account additional dry dock and launch costs in H1,” said TUI Group in a prepared statement for its first half year earnings released on May 15, 2019.

The company noted the launch of three new ships including the Mein Schiff 2, Marella Explorer 2 and Hanseatic Nature and said it continues to see good demand for these and the rest of its fleet.

“Load factor and yield performance remain in line with our expectations,” the company said.

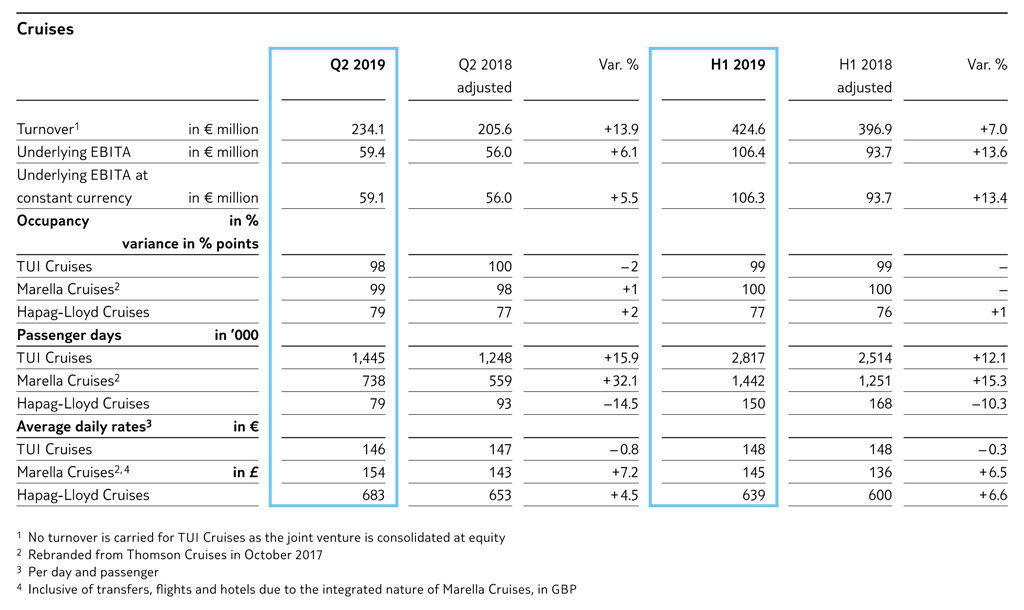

Cruise revenue was reported at 425 million euro versus 397 million euro for the first half of 2018.

Daily rates held at TUI Cruises at 148 euro, while they were up at Marella, reported at 145 euro versus 136 for the prior year.

Hapag-Lloyd also saw a notable increase with its daily rate going to 639 euro from 600 euro in the first half.

“The TUI Cruises result was ahead of prior year. As expected, the increase in capacity was offset by the earlier than originally planned launch of new Mein Schiff 2 in the low yield Q2 season, a planned dry dock for Mein Schiff Herz, and the exit of Mein Schiff 1 from the fleet in H2 FY18,” the company added.

Despite the increase in German cruise capacity, the company noted TUI Cruises’ first half performance was in line with the prior year, which it called a good performance.

“Hapag-Lloyd Cruises underlying EBITA increased on prior year, driven by the non-repeat of prior year dry dock and improved occupancy and rates across the fleet, partially offset by the exit of Hanseatic at the start of FY19,” the company noted.