LNG is the next fuel of choice due to its availability and cruise lines’ need to meet environmental regulations, according to Paul Davis, technical manager, risk assessment marine at Lloyd’s Register (LR).

LNG is the next fuel of choice due to its availability and cruise lines’ need to meet environmental regulations, according to Paul Davis, technical manager, risk assessment marine at Lloyd’s Register (LR).

“The market will choose the fuel,” he said, “and we (LR) will help the industry adapt to its fuel of choice in a safe and efficient manner. We have been interacting with the cruise industry, the IMO, the flag states and various other stakeholders, helping to shape regulations and guidelines for LNG, including bunkering.”

LR has classed several LNG-fueled vessels, including the Baltic cruise ferry, Viking Grace.

Meanwhile, RINA is working with Carnival Corporation on its first generation of LNG-fueled cruise ships. “We have been contracted for the first series of LNG-fueled cruise ships being built by Meyer Werft in Papenburg and Turku,” said Paolo Moretti, marine general manager. “We will class the newbuilds according to our classification rules for passenger ships with LNG-fueled service notation and will certify the vessels to be in compliance with the latest and most stringent international mandatory regulations, such as the IGF Code (International Code of Safety for Ships Using Gases or Other Low Flashpoint Fuels).

The 150,000-ton vessels will carry around 6,500 passengers and crew and fly the Italian flag.

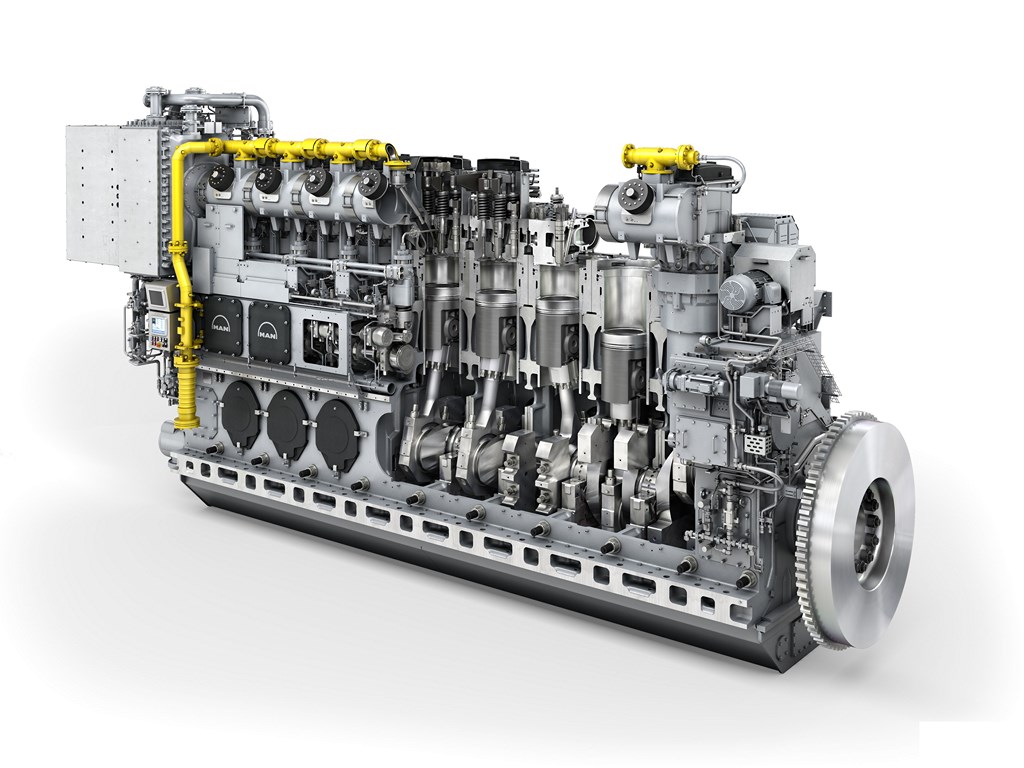

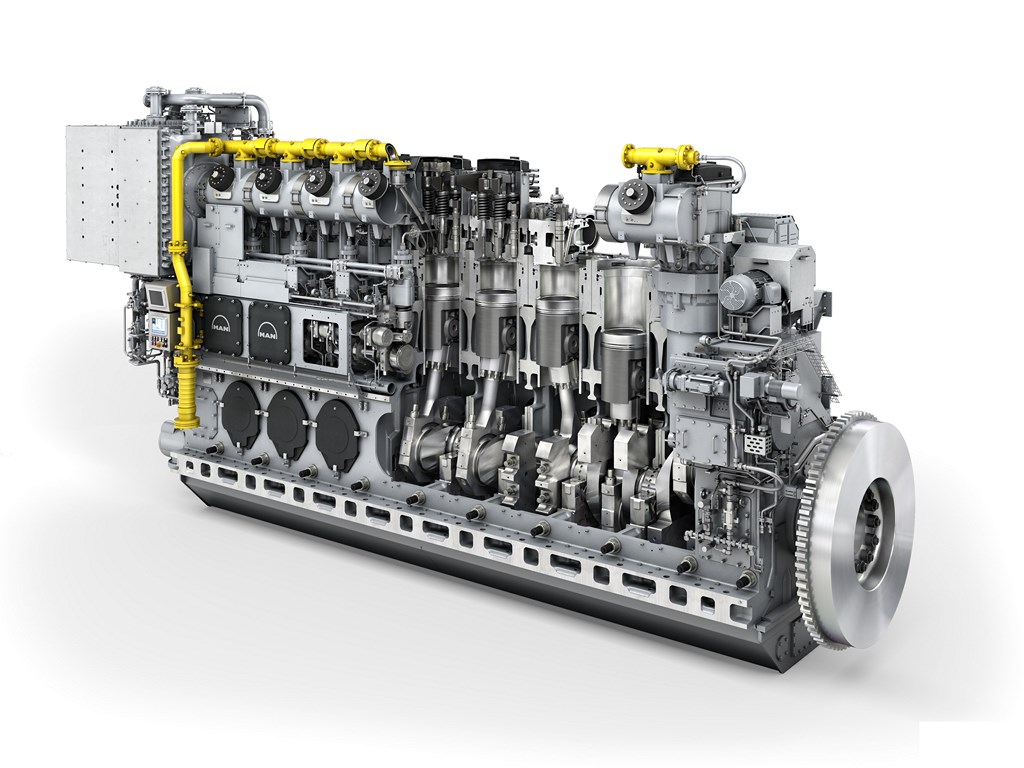

And the engine manufacturers are ready: MAN’s dual fuel engine portfolio for the marine market covers a wide power range from 1 MW (5L28/32DF) to almost 17 MW per unit (16V51/60DF), according to Sokrates Tolgos, responsible for sales to the cruise and ferry market for MAN Diesel & Turbo.

In addition, earlier this year MAN acquired the Swedish company Cryo, specializing in LNG storage and gas fuel supply systems aboard ships.

“We are now in a position to provide not only the engines, but all the cryogenic gas and safety technology from the tank up to the stack,” Tolgos said. “This will also allow those shipyards that cannot build up their own cryogenic technology to participate in the market for LNG-fueled ships in the future.”

At Wartsila, Timo Koponen, vice president, flow and gas solutions for Wartsila Marine Solutions, said: “We have been a strong believer in LNG for a long time to be financially feasible as a marine fuel and, of course, also eliminating the environmental issues related to burning HFO. It is one of the cornerstones of our overall strategy.”

While the company adapted its engine technology to LNG, it has also developed a fuel handling system – its so-called LNGPac, which is a complete gas handling system for LNG-fueled ships, including the bunkering station, tanks and related process equipment, as well as a control and monitoring system.

The gas turbine is also well positioned to be successful with LNG, according to Jeremy Barnes, commercial marine marketing director for GE’s marine gas turbine business. “You get the advantage of lower maintenance costs, compared to a reciprocating engine, so you can potentially reduce the number of engine-room crew onboard, and you get all the emissions performance, whether operating on gas or liquid fuels,” he said.

“The main difference is that with LNG, you can double your maintenance intervals, because the gas is so clean and so evenly distributed,” he continued. “With MGO, shipowners may get 12,500 hours between maintenance intervals, but with LNG that goes up to 25,000 hours, and we predict as much as 35,000 hours, because many of these applications will not run at full load all the time. Backing off just a few percent will make the service intervals even longer. We have seen this in our pipeline engines and these are the exact same engines. They are also the same engines that navies around the world use every day.”

Added LR’s Davis: “As a side benefit, LNG also contributes to a more competitive market for different fuels, providing shipowners with more options. Other spin-off benefits would be that it will drive innovation in areas like fuel efficiencies, engine designs and more.”

Excerpt from Cruise Industry News Quarterly Magazine: Fall 2016