The 11th annual China Cruise Shipping (CCS) conference and trade show will be held in Tianjin, September 23-25. CCS is hosted by the China Communications and Transportation Association (CCTA) and organized by the China Cruise and Yacht Industry Association (CCYIA).

This year’s theme is “The Development and Cultivation of Asian Cruise Tourism Destinations.”

Since 2006, the event has been held in six cities, including Beijing and the port cities of Shanghai, Xiamen, Sanya, Shenzhen and Tianjin.

2015’s event was a gathering of the who’s who of the major cruise lines in Shanghai, along with suppliers and ports.

There are panel discussions and forums over the first two days in Tianjin, offering a unique speaker lineup.

On the trade show floor, international and Chinese suppliers will be looking to do business with both major cruise lines and new Chinese startups.

The show aims to promote the development of the Chinese cruise industry, bringing together leaders from various government bodies and ports in China with cruise line executives and suppliers.

The show also aims to promote China’s industry-related policies.

It has become the stage for industry players and the Chinese government to announce key cruise developments and policies. It also aims to nurture domestic cruise tourism and bring China’s vast industry potential to the world.

Market Potential

With a quickly growing Chinese source market and with all major cruise lines homeporting in China and most building new ships for the market, transit ports need to keep pace with the industry’s growth.

“China’s growing homeport business faces huge limitations in terms of ports of call,” said Weihang Zheng, vice president and secretary (the de-facto CEO) of the CCYIA. “Currently, destinations are limited to Japan and Korea, and to a smaller extent, Hong Kong, Taiwan, Singapore and Vietnam.”

He cited some potential areas of expansion. “Japan has many potential ports. We are now limited mainly to Kyushu. We can also go south, to Southeast Asia for week-long cruises. Another potential is to go north, to Russia. There is a lack of awareness and marketing so more can be done in this area.”

The show plans to address the need for more ports and destinations for ships sailing from China.

“It will take two to three years to see progress and results,” Zheng said. “But if we do not address them now, it will become a crippling bottleneck.”

Conference Program

CCS will be anchored by its industry leaders forum, focus-ing on the future of the big companies in Asia. Last year’s top speakers are expected to be back, including Arnold Donald, Adam Goldstein, Frank Del Rio and Gianni Onorato.

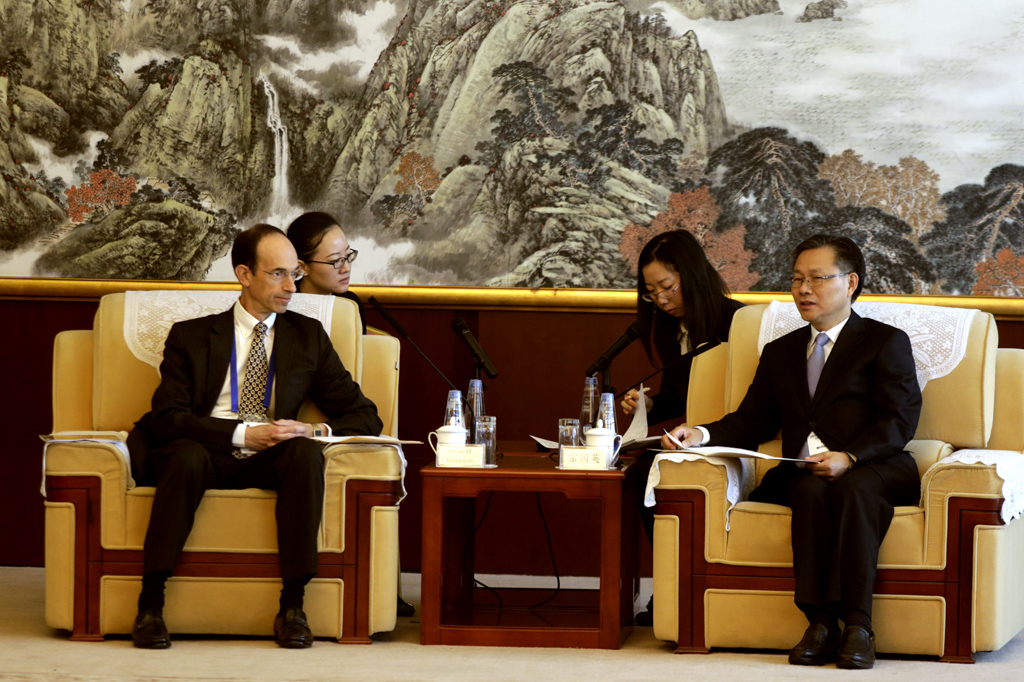

There will also be a government and cruise line round-table to discuss growing the industry in China.

Brand management for the Chinese market will also be in attendance and will have its own dedicated panel discussion.

There is also a cruise destination forum, featuring port executives as well as a cruise city forum, talking about tourism and shore excursion resources.

The Japanese government’s Ministry of Land, Infrastructure, Transport and Tourism announced in April the establishment of a Cruise Revitalization Office under the Ports and Harbor Bureau that will be responsible for attracting cruises and improving ports.

“Including Japan and Korea, there is a lack of ports that can accommodate cruise ships,” said Zheng. “But the new office by the Japanese government is an excellent step forward, and these positive developments are the result of a collaborative effort by the industry, CCYIA and other parties. In contrast, government-to-government interactions are still lagging behind.”

Part of the Japanese effort is a no-rejection policy, meaning if one port is booked, they will find an alternative berthing location.

Cruise-ship building will also be discussed at CCS with a shipbuilding panel.

“China State Shipbuilding Corporation (CSSC) has made significant progress in this area,” added Zheng.

Another panel will focus on repair. as there is a significant lack of cruise drydock experience in the region.

In addition there will be a cruise tourism development forum that will include a 2017 market analysis, exploring different cruise sales models, as well as announcing the results of a cruise consumer survey that CCYIA will conduct over the summer.

China is also building up its efforts in procurement, as a clear tangible benefit from more ship calls, and similar to last year, there will be a procurement forum to explore the supply-chain side of the industry.

Finally, there will be a recruitment forum to discuss educa-tion options, focusing on training crew for ships sailing in China.

Trade Show

Held concurrently with the conference each year is a growing trade show. This year’s show will include four key exhibition areas with a heavy focus on suppliers, food and beverage, cruise ship building and repair, and ports and destinations. Over 2,000 visitors are expected.

According to the organizers, the show expects more port and destination exhibitors to attend, as well as suppliers, recruitment agencies and travel agents.

Zheng said he also expects more suppliers because Chinese shipbuilding and ship repair facilities are developing.

News Expected

The CCS has been a hotbed of news items in recent years, and 2016 will be no exception with major announcements expected from CSSC and a number of cruise lines. Also in the works is a China Cruise Travel Agency Alliance.

Tianjin last hosted the CCS show in 2014. Tianjin is the port to Beijing and is part of the new Beijing-Tianjin-Hebei collaborative development to jointly grow the northeastern triangle of China with a population of 110 million. Though its cruise business only started in 2010, Tianjin has become the second largest cruise port in mainland China, after Shanghai, with 93 calls and 431,000 passengers in 2015. Its Tianjin Inter-national Cruise Terminal (TICT) has expanded rapidly and can now berth three megaships at once.