Carnival Corporation announced adjusted net income for the full year 2015 of $2.1 billion, or $2.70 diluted EPS, compared to $1.5 billion, or $1.93 diluted EPS, for the prior year.

Full year 2015 U.S. GAAP net income was $1.8 billion, or $2.26 diluted EPS, which included unrealized losses (non-cash) on fuel derivatives of $332 million and other net charges of $17 million. Full year 2014 U.S. GAAP net income was $1.2 billion, or $1.56 diluted EPS, which included unrealized losses (non-cash) on fuel derivatives of $268 million and other net charges of $20 million.

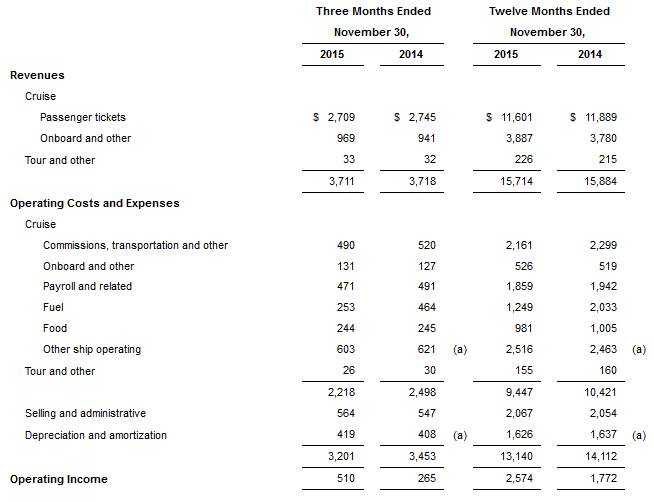

Revenues for the full year 2015 were $15.7 billion compared to $15.9 billion for the prior year due to the unfavorable impact from currency exchange rates of over $800 million.

Carnival Corporation & plc President and Chief Executive Officer Arnold Donald noted, “We nearly doubled our fourth quarter results and ended the year with 40 percent higher earnings. Strong operational execution delivered $0.25 per share higher earnings than the mid-point of our full year 2015 December guidance, despite a $0.10 drag from the net impact of currency and fuel prices. This year we achieved a 4.3 percent improvement (constant currency) in revenue yields compared to the prior year due to higher onboard revenues and increased ticket prices as we have driven demand in excess of capacity growth, while our ongoing efforts to leverage our industry-leading scale helped to contain costs. Our strong performance led to record operating cash flow of well over $4 billion versus $3.4 billion last year,” Donald stated.

Key metrics for the fourth quarter 2015 compared to the prior year were as follows:

- Net revenue yields (net revenue per available lower berth day or “ALBD”) increased 4.1 percent in constant currency, which was better than the company’s September guidance, up 3 percent. Gross revenue yields decreased 2.5 percent in current dollars due to changes in currency exchange rates.

- Net cruise costs excluding fuel per ALBD increased 3.2 percent in constant currency, which was in line with September guidance, up 3 percent. Gross cruise costs including fuel per ALBD decreased 10.7 percent in current dollars.

- Fuel prices declined 46 percent to $316 per metric ton for 4Q 2015 from $584 per metric ton in 4Q 2014 and were better than September guidance of $366 per metric ton.

- Changes in currency exchange rates reduced earnings by $0.08 per share.

- Adjusted net income was $389 million, or $0.50 diluted EPS, before U.S. GAAP unrealized losses (non-cash) on fuel derivatives of $117 million, or $0.15 diluted EPS. U.S. GAAP net income was $270 million, or $0.35 diluted EPS.

- The company repurchased approximately 8 million shares under its $1 billion stock repurchase program. position in China, which is expected to, over time, surpass North America as the world’s largest cruising region.

2016 Outlook

At this time, cumulative advance bookings for the first three quarters of 2016 are well ahead of the prior year at slightly higher constant currency prices. Since September, booking volumes for the first three quarters of 2016 are in line with last year’s levels at higher prices.

Donald noted, “As we had anticipated, with less inventory remaining for sale, we have begun to sell at higher prices than the same time last year, particularly close to departure, affirming our expectation of continued yield improvement in 2016.”

Based on current booking trends, the company forecasts full year 2016 net revenue yields in constant currency to be up approximately 3 percent compared to the prior year, of which approximately 1 percent is due to an accounting reclassification for the Europe, Australia and Asia segment. The company expects net cruise costs excluding fuel per ALBD in constant currency for full year 2016 to be up approximately 2 percent, of which approximately 1.5 percent is also due to the reclassification. The reclassification has no impact on operating income.

Current currency exchange rates and fuel prices, net of fuel derivatives, are $0.22 per share favorable compared to the prior year. Taking the above factors into consideration, the company forecasts full year 2016 adjusted earnings per share to be in the range of $3.10 to $3.40, compared to 2015 adjusted earnings of $2.70 per share.

Looking forward, Donald stated, “We have accelerated progress toward and remain well positioned to achieve our double digit return on invested capital threshold in the next two to three years. Over time, we expect to continue to return excess cash to shareholders as demonstrated by our recent 20 percent increase in quarterly dividends and more than $400 million in share repurchases.”

First Quarter 2016 Outlook

First quarter constant currency net revenue yields are expected to be up 3.5 to 4.5 percent compared to the prior year. Net cruise costs excluding fuel per ALBD for the first quarter are expected to be 2.5 to 3.5 percent higher in constant currency compared to the prior year. Based on the above factors, the company expects adjusted earnings for the first quarter 2016 to be in the range of $0.28 to $0.32 per share, compared to 2015 adjusted earnings of $0.20 per share.