Two-stage turbocharging and electronic fuel injection with intelligent power management will be the next development steps for medium-speed, four-stroke diesel-engine technology for cruise ships, according to Sokrates Tolgos, head of sales, cruise and ferry for MAN Diesel & Turbo.

Two-stage turbocharging and electronic fuel injection with intelligent power management will be the next development steps for medium-speed, four-stroke diesel-engine technology for cruise ships, according to Sokrates Tolgos, head of sales, cruise and ferry for MAN Diesel & Turbo.

He said that two-stage turbocharging allows for more efficient fuel consumption and lower NOx emissions by increasing the compression pressure.

Electronic fuel injection also offers the potential of reduced fuel consumption. Tolgos said: “In a multi-engine installation with intelligent power management, engines can run on different fuel injection maps and loads. You can arrange the load of each engine so it is running at its optimal load point by adapting the injection parameters.”

At Wartsila, Lars Anderson, vice president of 4 stroke sales, said: “Cruise lines must consider how to combine reducing fuel consumption and emissions. You can tune an engine to reduce fuel consumption, but that can have an adverse effect on NOx. Thus, you need to look at both sides, and it also depends on where a ship is operating – whether mostly on the open ocean or in ECA areas.”

Anderson said the company is receiving more LNG inquiries, and he expects that in a couple of years there will be newbuilds ordered with at least a couple of engines running on gas. He noted that it would be a good solution for Alaska and the Baltic.

Among those eager for LNG to enter the cruise market is General Electric. “When we were winning (cruise) contracts, fuel prices were much closer. That may change again as we move forward and LNG becomes more readily available. Low-sulfur fuel will also close the price difference,” said Jeremy Barnes, commercial marine director for GE Marine.

“With LNG there will be no difference in fuel costs between gas turbines and diesel engines. In addition, the gas turbine takes much less space and is more environmentally friendly, already meeting Tier 4 emissions. So, we see (commercial) marine application scenarios for the turbine.”

As for the near future, Wartsila’s Anderson said the need to reduce emissions will continue to be the primary driver. “If you ask me how to comply with Tier III, I will answer: ‘LNG.’ Problem solved. But with liquid fuel, the market has not yet decided what the solution will be. Technology is evolving, but is not yet at the stage where we can avoid having after equipment in the funnel. We will see more flexible engines, optimizing both consumption and emissions over a wider performance load.”

GE recently signed a memorandum of understanding with Lloyd’s Register (LR), and Barnes said that they will jointly be looking at possible marine applications of gas turbines in commercial shipping. “Through this agreement,” he said, “we are combining GE technology with LR market access. We will have more access to market data and be able to better define what the applications may be, as well as identify customers willing to be pioneers.” Covering commercial shipping, the effort is not limited to cruise, although Barnes expects there to be opportunities for cruise ships as well.

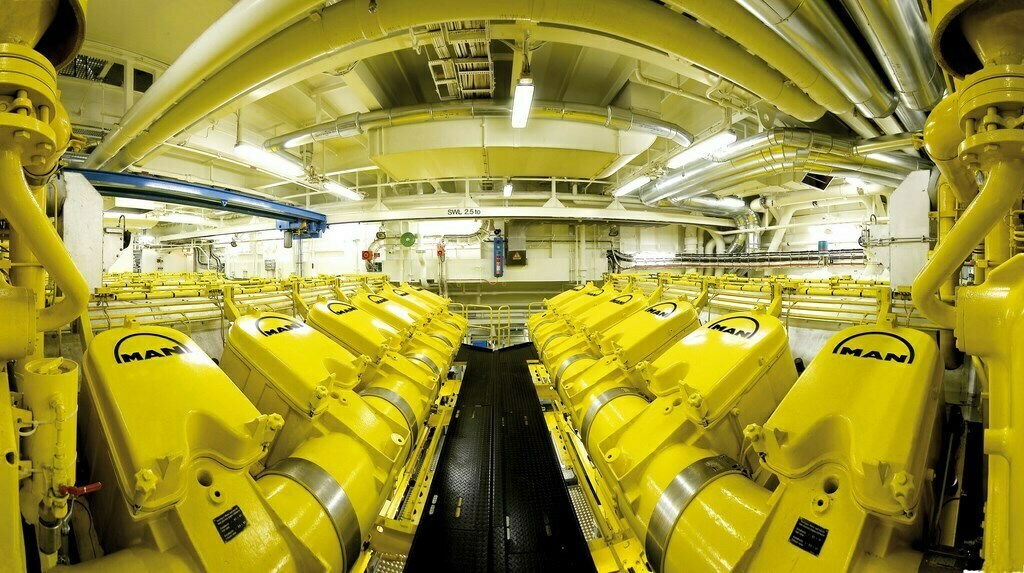

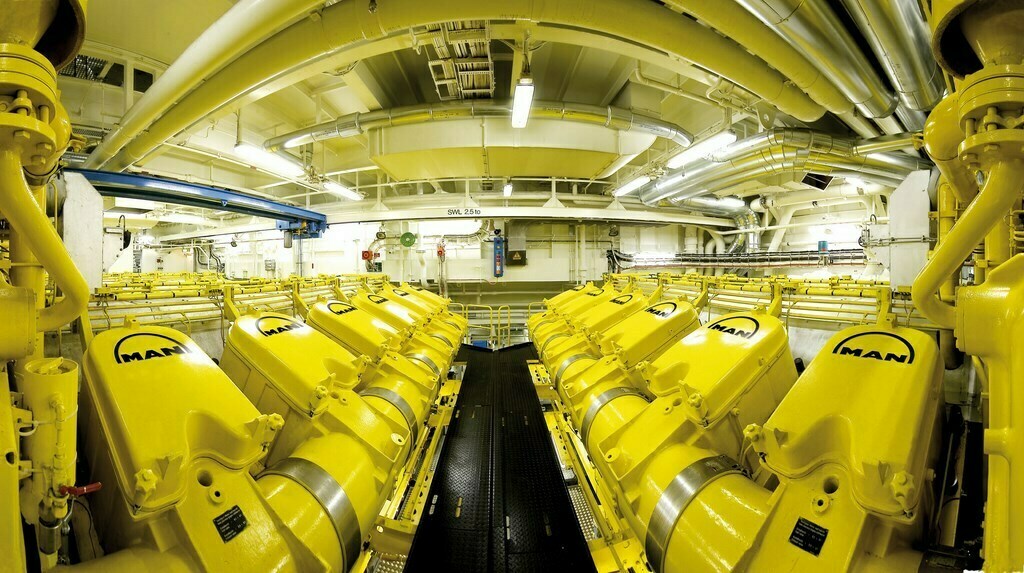

Among MAN’s current newbuild installations is the Carnival Vista with two V14 engines in one engine room and three eight-cylinder engines in the other. Scheduled to enter service in 2016, the ship will have 62.4 MW of installed power. This is more engine power than necessary, according to MAN’s Tolgos, providing Carnival with additional redundancy. He said that with more efficient hotel operations and slower sailing speed, the industry trend is for less installed power, but that this is partially offset by redundancy requirements.

Excerpt from Cruise Industry News Quarterly Magazine: Fall 2014